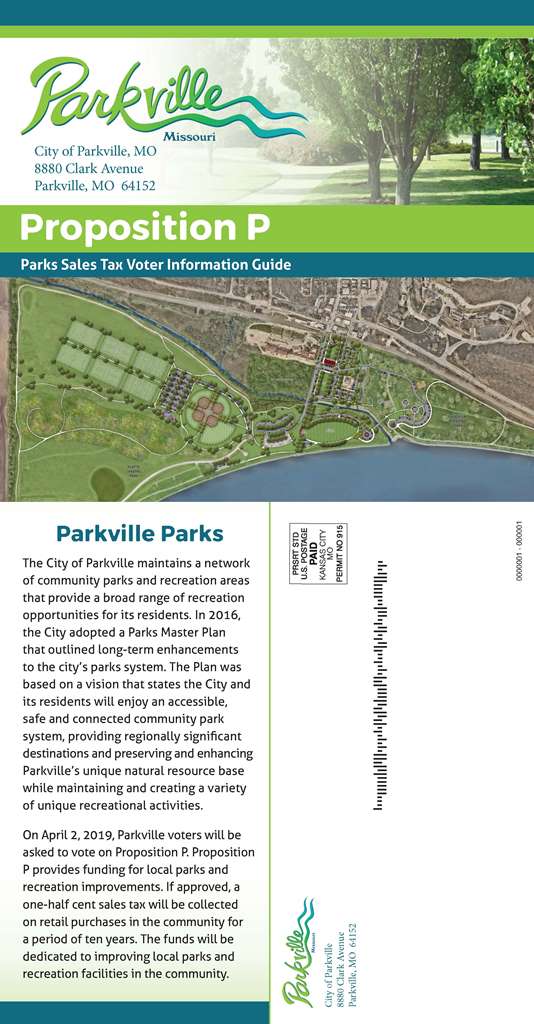

On April 2, 2019, Parkville residents were asked to vote on Proposition P, a referendum to impose a sales tax of 1/2 of one percent for the purpose of providing funding for local parks, including land, facilities and operations for the City for a period of 10 years. Proposition P was approved by 68.82% and took effect on October 1, 2019.

Ballot Language

Shall the City of Parkville, Missouri, be authorized to impose a sales tax of one-half of one percent for the purpose of providing funding for local parks including land, facilities and operations for the City for a period of 10 years?

The sales tax is estimated to provide approximately $500,000 each year to improve the city’s parks and recreation facilities. Over a ten year period, these funds would be supplied to building new park and recreation facilities and maintaining existing facilities.

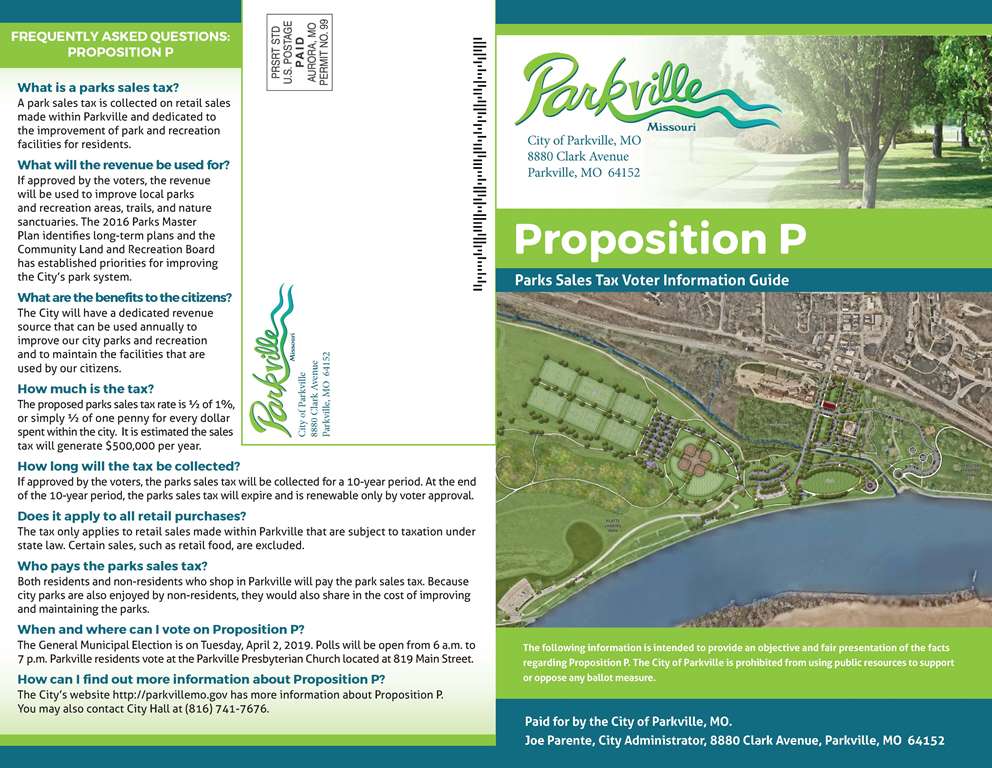

The City of Parkville maintains over 200 acres of parkland, including English Landing Park, Platte Landing Park, the Parkville and Sullivan nature sanctuaries and several neighborhood parks.

The 2016 Parks Master Plan was created to provide a road map for the utilization, development and expansion of Parkville’s current and future park system. The total cost to complete the recommendations in the Plan is estimated between $4.8 million and $7.7 million. Prior to Proposition P, funding averaged $150,000 annually for maintenance and new projects. Grants contributed up to $50,000 annually. At the previous rate of funding, the Plan was estimated to take 24 to 38 years to complete.

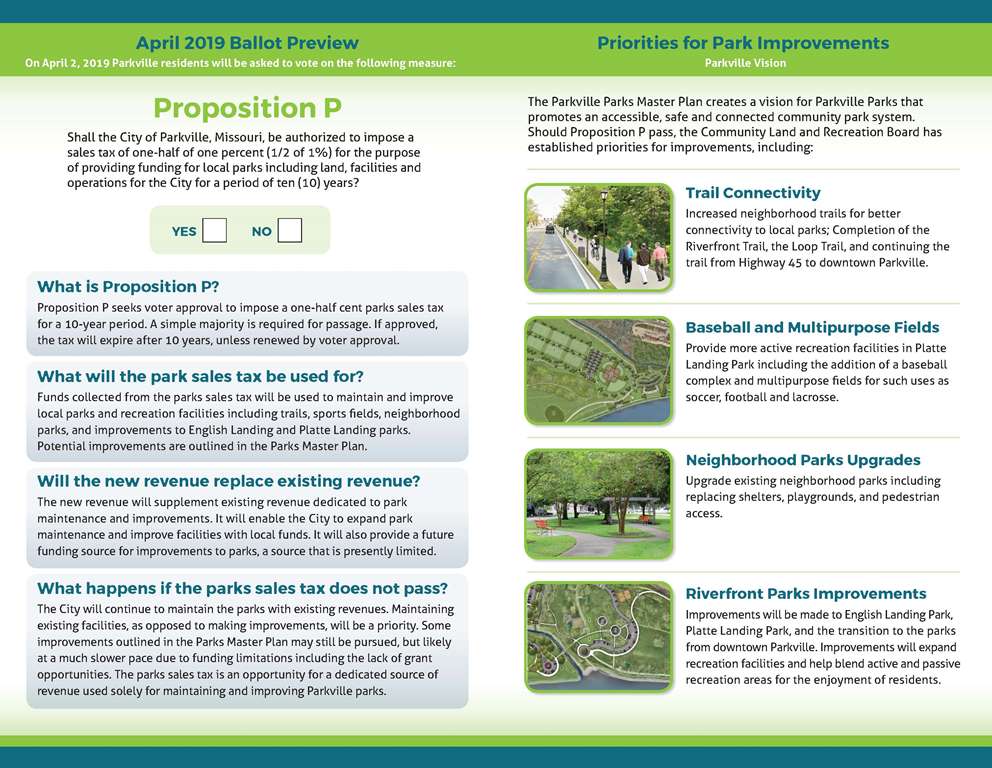

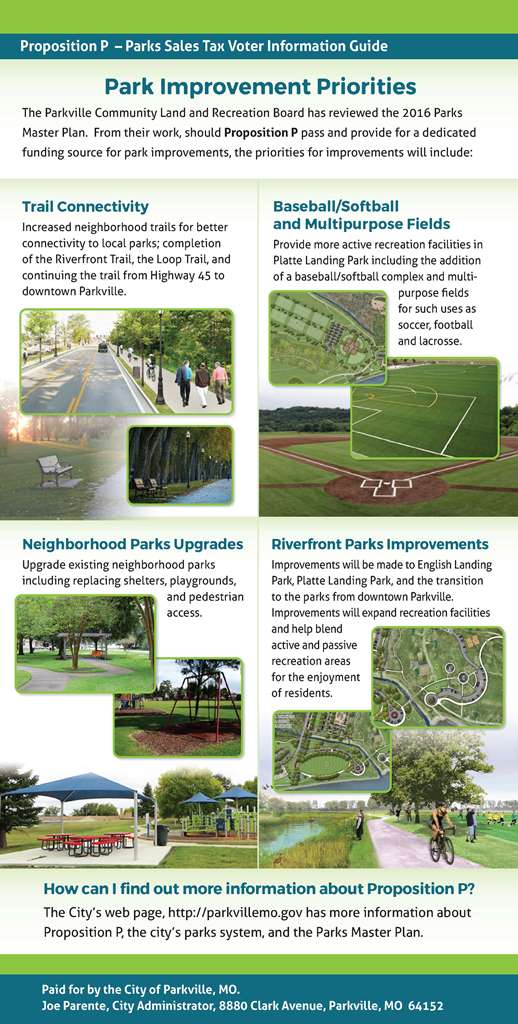

The Community Land and Recreation Board (CLARB) prioritized projects for improvements to the City’s park system. The top three priorities included 1) trail connectivity; 2) completion of the ballfields and multipurpose fields in Platte Landing Park; and 3) upgrade to and maintenance of smaller neighborhood parks and trails that have a more direct impact to community members in the area. Other projects identified in the Parkville Parks Master Plan would also be considered for improvement.

The City is currently working on several projects using revenue from the parks sales tax. More information on these projects is available on our Park Projects page.

Projects CLARB would like to see completed include:

- Brush Creek Trail

- Completion of loop trail

- Completion of wetlands project

- Construction of multipurpose and baseball fields

- Additional parking to accommodate new amenities

- More trail connections within the city to improve access to as many residents as possible

Educational Materials

Flyer #1

Flyer #2

Spring 2019 Parkville Newsletter

Frequently Asked Questions

A park sales tax is collected on retail sales made within Parkville and dedicated to the improvement of park and recreation facilities for residents. All revenue received from the local park sales tax is used “soley for funding local parks and related activities and improvements.”

The park sales tax rate is proposed for ½ of 1%, or simply ½ of one penny. It will add an additional fifty ($.50) cents for every one hundred ($100.00) you spend within the city.

The tax only applies to retail sales made within the Parkville that are subject to taxation under the provision of Section 144.010 to 144.525 RSMo. Certain sales, such as retail food and automobiles, are excluded.

It is estimated the sales tax will generate approximately $500,000 per year.

All revenue received from the local park sales tax will be used “solely for local parks for the City, in order to purchase, improve and manage parks, trails and natural lands for recreation and other natural preservation purposes. The tax will be used to add amenities in existing parks and trails, nature sanctuaries, and to fund major repairs, renovations, and replacements to existing parks, trails and recreation facilities.

Yes. The City’s Community Land and Recreation Board, made up of Parkville residents, has established priority improvement to the City’s park system. The top three priorities include 1) trail connectivity; 2) completion of the ballfields and multipurpose fields in Platte Landing Park; and 3) upgrade to and maintenance of smaller neighborhood parks and trails that have a more direct impact to community members in the area. Other projects identified in the Parkville Parks Master Plan would also be considered for improvement.

The City will have a dedicated revenue source that can be used annually to improve City parks and recreation facilities.

If approved by the voters, the sales tax will be collected for a 10-year period. At the end of the ten year period, the park sales tax will expire and is renewable only by voter approval.

Both residents and non-residents who shop in Parkville will pay the park sales tax. City parks are used by residents and non-residents. Imposing the sales tax helps assure both residents and non-residents pay toward improving the parks.