APRIL 4, 2023, GENERAL MUNICIPAL ELECTION

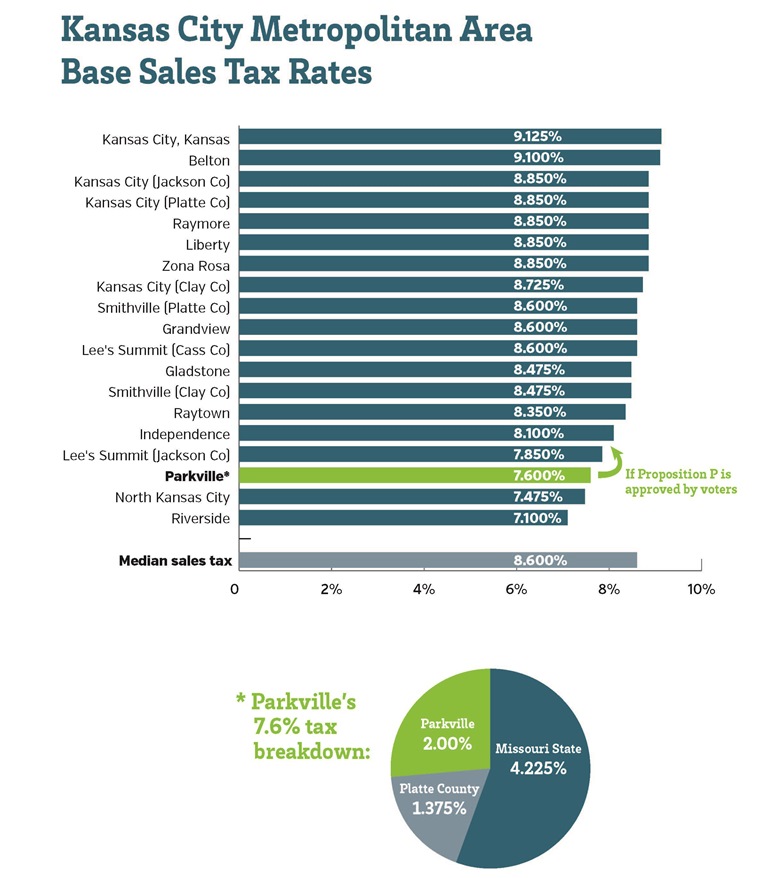

On April 4, 2023, two propositions – Proposition P for public safety sales tax and Proposition U for a use tax – were on the General Municipal Election ballot. Proposition P passed and Proposition U failed.

Proposition U:

The ordinance asks voters to consider imposing a local use tax on out-of-state purchases, at a rate equal to the rate of local sales tax in effect in Parkville, 2%. Funds generated would be dedicated to infrastructure and capital improvements throughout the city such as the next phase of improvements to Highway 9.

Proposition P:

This ordinance asks voters to consider imposing a citywide ½ percent public safety sales tax to be placed on all retail sales made in the City of Parkville. Funds generated would be dedicated to the use of public-safety related purposes, including police equipment, competitive salaries and benefits and facilities.

Documents

- Spring 2023 Newsletter (external link)

- ProParkville Video (external link)

- Proposition U Ordinance No. 3147 (PDF link)

- Proposition P Ordinance No. 3148 (PDF link)

GENERAL PROP U AND PROP P QUESTIONS

If approved by voters, the public safety sales tax and use tax would go into effect July 1, 2023.

<!--Kansas City Metropolitan Area Sales Tax

| Zona Rosa | 9.850% | Grandview | 8.600% |

| Belton | 9.6% | Gladstone | 8.475% |

| Kansas City, KS | 9.125% | Smithville (Clay County) | 8.475% |

| The Legends | 9.125% | Raytown | 8.375% |

| Kansas City (Jackson County) | 8.850% | Independence | 8.100% |

| Kansas City (Platte County) | 8.850% | Lee's Summit (Cass County) | 8.100% |

| Raymore | 8.850% | Lee's Summit (Jackson County) | 7.850% |

| Liberty | 8.850% | Parkville* | 7.600% |

| Kansas City (Clay County) | 8.725% | North Kansas City | 7.475% |

| Smithville (Platte County) | 8.600% | Riverside | 7.100% |

Sales taxes in many of the shopping areas you visit metro-wide will be above the base rates due to CIDs and TIFs approved by their respective municipal authorities.

Election day is April 4, 2023. Polls will be open from 6 am to 7 pm. Parkville residents vote at the Parkville Presbyterian Church, 819 Main Street.

March 8, 2023.

If the Propositions U and P fail to secure the necessary majority votes on April 4th, the City will explore other opportunities, such as an increase in property tax, to fund infrastructure improvements and public safety for our community.

After examining the City’s budget and studying peer cities, the Mayor and aldermen decided the most prudent way forward would be to ask voters to approve a use tax and a public safety tax. Online shopping continues to cut into Parkville’s local sales tax collections; additionally, with the rate of inflation and our population growth, the City is looking to raise the necessary dollars in order to offer competitive officer salaries as we strive to have the best Police Department possible. Also, we need a source of funds to leverage the matching Federal and state grants the city is applying for – and receiving – to improve our streets and sidewalks.

PROPOSITION U: USE TAX

Shall the City of Parkville, Missouri impose a local use tax (a sales tax on purchases made from out-of-state sellers by in-state buyers and on certain intrabusiness transactions) at the same rate as the total local sales tax rate, for the purpose of funding infrastructure and capital improvements within the City, provided that if the local sales tax rate is reduced or raised by voter approval, the local use tax rate shall also be reduced or raised by the same action?

A local use tax is a tax imposed on the storage, use or consumption of tangible, personal property. If approved, a local use tax would be applied to goods and services purchased, delivered, and used in Parkville from online and out-of-state vendors. The use tax rate would be charged instead of a sales tax. It’s one or the other tax, never both.

With assistance from the Missouri Municipal League, the city estimates the use tax will generate $250,000 – $300,000 per year.

Example: A $100 online order of pet food from a company like Amazon.com would result in an additional $2.00 of Use Tax to the City that would be used only for infrastructure-related projects (streets, curbs, storm-water, etc.) or capital improvements within the city.

If approved, funds from the use tax will aid in funding of infrastructure and capital improvements within the city to maintain its charming, walkable qualities. Additional resources will help continue much-needed roadway projects, similar to the Highway 9 project recently completed. For example, funds from the use tax will help support the Highway 9/East Street/First Street triangle project and improvements to Bell Road for sidewalks that will improve pedestrian connectivity and safety while traversing in this area.

Additionally, the City will continue to pursue grant opportunities like federal funds via the recently passed Bipartisan Infrastructure Law. However, they require a local match up to as much as 50% of the funding. Use tax revenues can help provide the local required match to receive federal funds. Should Proposition U pass, revenues collected are dedicated funds that can ONLY be used on infrastructure (like roads, bridges, stormwater, etc.) and capital improvements projects.

There is no sunset.

To maintain existing City services and provide the capital improvements our residents expect, the City needs to modernize its revenue sources to keep pace with current and evolving retail purchasing trends. According to the U.S. Department of Commerce Statistics, ecommerce sales accounted for more than 14% of all retail sales in the U.S. ($861 billion), and ecommerce sales are forecast to rise to nearly 22% by 2025. It is anticipated this trend will continue as more and more people shop online and with out-of-state vendors. A local use tax will eliminate the disparity in tax rates collected locally and from out-of-state and online vendors. Moreover, it will create a source of funding to leverage the matching Federal and state grants the City is applying for – and receiving – to improve our streets and sidewalks.

NO. A local use tax will NOT increase or change our local sales tax. If approved, the use tax will be applied to out-of-state and online purchases. The use tax is in place of a sales tax so it is only collected when sales taxes are NOT collected. A local use tax would be applied to goods purchased, delivered and used in Parkville from certain online and out-of-state vendors. The current sales tax rate received to the City is 2%. If approved, the use tax would be the same as the city sales tax. Buyers NEVER pay both a use tax and local sales tax on the same transaction.

Yes. In the metro, Independence, Lee’s Summit, Liberty, Gladstone, Grandview and Clay County (just to name a few) have passed a use tax. Also our nearby neighboring municipalities of Kansas City, Riverside, Platte City and Platte County all have a use tax in place. Statewide, nearly half of Missouri cities have a use tax in place.

Yes. Currently, Parkville’s local retailers collect sales taxes. Some out-of-state retailers collect local taxes while others do not. The use tax will subject all out-of-state and online retail sales purchased to the same tax rate.

Yes. If an item is exempt from state and local sales tax, it is also exempt from the state and local use tax. The use tax will not apply to utilities, gasoline or prescription drugs.

Just like a sales tax, the State of Missouri collects use taxes from businesses and individuals and distributes those revenues to the cities and counties that have a use tax. Businesses generally file Use Tax Returns along with their sales taxes. Many retailers are now collecting use tax from customers on catalog or online purchases. For individuals, the State of Missouri currently relies on self-reporting on a use tax return if the individual has more than $2,000 in out-of-state purchases subject to use taxes on which such taxes were not paid. For simplicity, the Use Tax Return is a part of your annual tax return. If you are filing a Use Tax Return now for the existing State and County use taxes, you would add the City portion.

The City of Parkville will be negatively impacted by online sales that continue to rise with no use tax collected for City services. The City will experience continued revenue decreases for infrastructure needs like the multiple phases of the Highway 9 improvements and the sidewalk project on Bell Road. The City’s Board of Aldermen will need to look at other options, including possibly raising property taxes, which have been held level for the past 10 years, and/or declining grants for these projects, as there would be no City funds to leverage grant proceeds to complete the projects. Additionally, the City will be less likely to receive future Federal grant funds without a local match.

Without a use tax in place, a resident can purchase the same item online that they could purchase from a Parkville store, but they don’t have to pay sales tax on the online item. This creates a disadvantage to local businesses because it makes the same product seem more expensive in a Parkville store due to the local sales tax. A local use tax eliminates the disparity in tax rates collected by local and out-of-state sellers by imposing the same rate on all sellers.

Out-of-state sellers profit from Parkville buyers, but without a use tax in place, out-of-state sellers do not pay for street maintenance (Parkville streets support multiple delivery trucks daily) or police protection associated with traffic and package thefts.

PROPOSITION P: PUBLIC SAFETY SALES TAX

Shall the City of Parkville impose a citywide sales tax of one-half of one percent for the purpose of improving the public safety of the City, including but not limited to, Police positions, salaries and benefits, and related expenditures on police facilities and equipment?

The City is asking for a citywide ½ percent increase in the sales tax to be placed on all retail sales made in Parkville.

The public safety sales tax will generate about $325,000 in the first year due to partial-year collections, and approximately $650,000 annually thereafter.

Due to the large number of visitors to Parkville, the City’s Aldermen chose a sales tax rather than a property tax to capture the revenue needed for the City’s public safety improvements. Visitors to Parkville benefit from the services of the City’s police department and a sales tax is a way for visitors to contribute funding to public safety services.

Revenues from Proposition P will provide our local police force with the dedicated funding and resources they need to attract and retain top talent to keep our community safe and thriving, including more competitive salaries and the opportunity to hire two open positions and two new staff planned. This totals four more officers on the roster than what we have today. It will support new community policing activities and a new satellite police location on the western side of Parkville, as well as a modernized fleet and state-of-the-art equipment to stay current with policing trends to support our residents and businesses.

Revenues generated from Proposition P are dedicated funds that can only be used for public safety projects. These funds are restricted to the use of public safety-related purposes and will provide a dedicated funding source for the police department.

There is no sunset.

The Mayor and Aldermen have pledged to continue funding public safety from the General Fund at current levels, but there is not enough money in the General Fund budget to hire additional officers planned and provide for community policing to adequately represent all areas of the city. The potential revenue generated by a public safety sales tax would be in addition to continued funding of public safety received from the General Fund. With the additional funds received from Proposition P, the police department will be able to attract and retain employees through competitive salaries and benefits, continuing to provide expanded services for the City and retain Parkville’s premier community status.

The safety of our community is one of the primary reasons why people choose to live in Parkville. Demands on public safety continue to increase; additional funding allows the City to continue providing excellent service to residents today, meet future demands and protect our quality of life. Passage of Proposition P will also allow the Police Department to provide expanded patrolling across the City.

“One of the activities our Parkville police officers enjoy most is spending time in the community, interacting with their fellow citizens. But lately, due to an increase in call volume and police staff shortages, our time to engage in relationship building has been reduced and we strongly embrace the community policing philosophy. With the passage of Proposition P, we would have dedicated funds for the two open positions and two new positions added in 2022 for a total of four more police officers, along with efforts toward a satellite location to provide representation across the City.”

– Parkville Chief of Police Kevin Chrisman

Yes. A number of our neighboring cities such as Grandview, Independence, Blue Springs, Kansas City, Raymore, Raytown, Riverside and Greenwood have a public safety sales tax.

Everyone who shops in Parkville – both residents and non-residents who rely on public safety while in Parkville – will pay for the public safety sales tax. This sales tax will not apply to utilities (electric, water and natural gas), gasoline or prescription drug purchases.

The Parkville Police Department will continue to provide the best services possible with the resources available. Without funds for competitive salaries, recruiting and retaining police will be increasingly difficult.

In the current system, the public safety funds available to public safety are competing against all of the other needed services funded through the General Fund. Revenues from Proposition P would provide a dedicated revenue stream that would fund public safety without competing against other programs and services within the City.