Ballot Language | Frequently Asked Questions | Educational Materials | Background on 2004 Levy

The City of Parkville held a special election on August 5, 2025, on Proposition C – “C”ity Infrastructure, “C”ity Facilities, Results of “C”itzen Survey. Proposition C failed.

Ballot Language

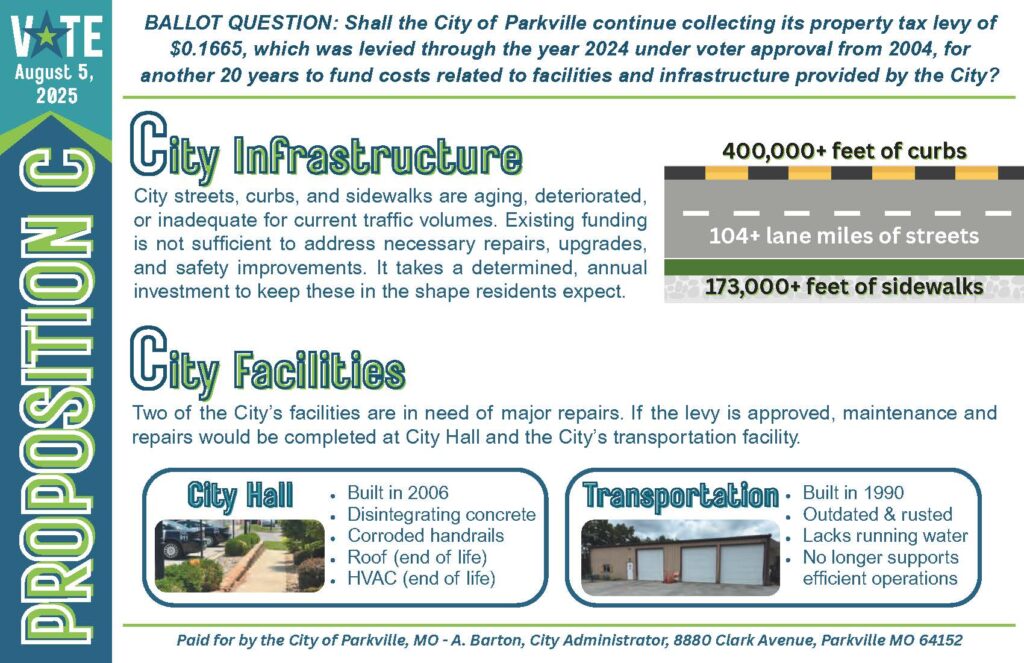

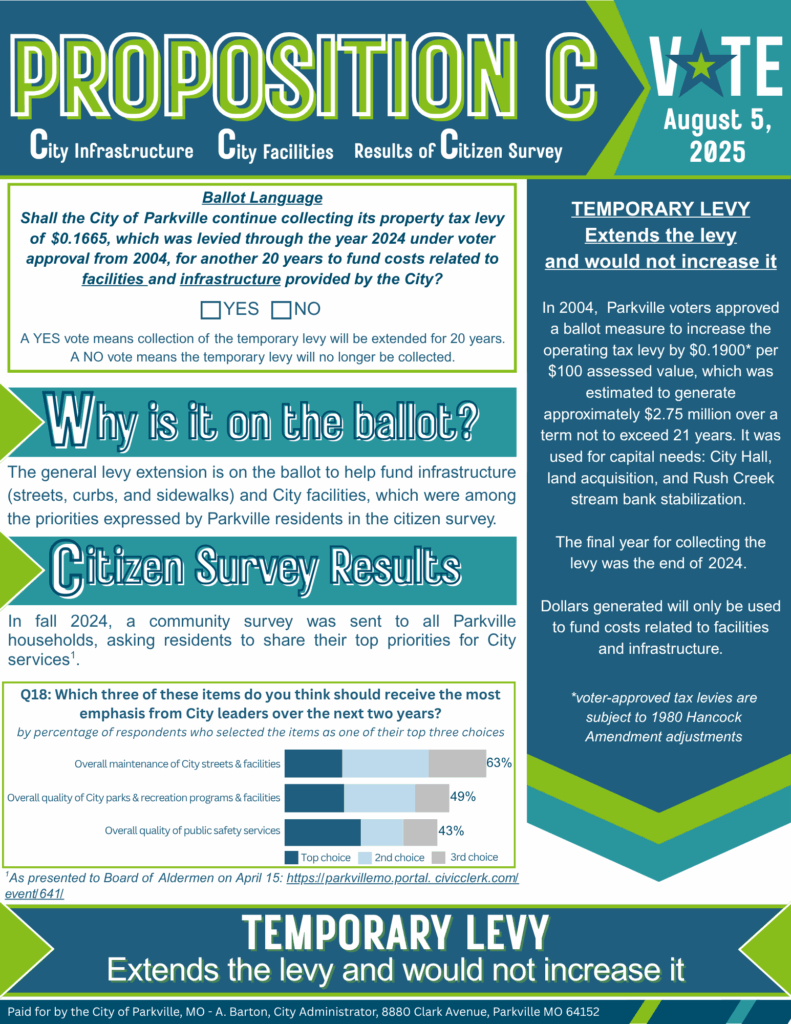

Shall the City of Parkville continue collecting its property tax levy of $0.1665, which was levied through the year 2024 under voter approval from 2004, for another 20 years to fund costs related to facilities and infrastructure provided by the City?

A YES vote means the temporary levy will be collected for 20 more years.

A NO vote means the temporary levy will no longer be collected.

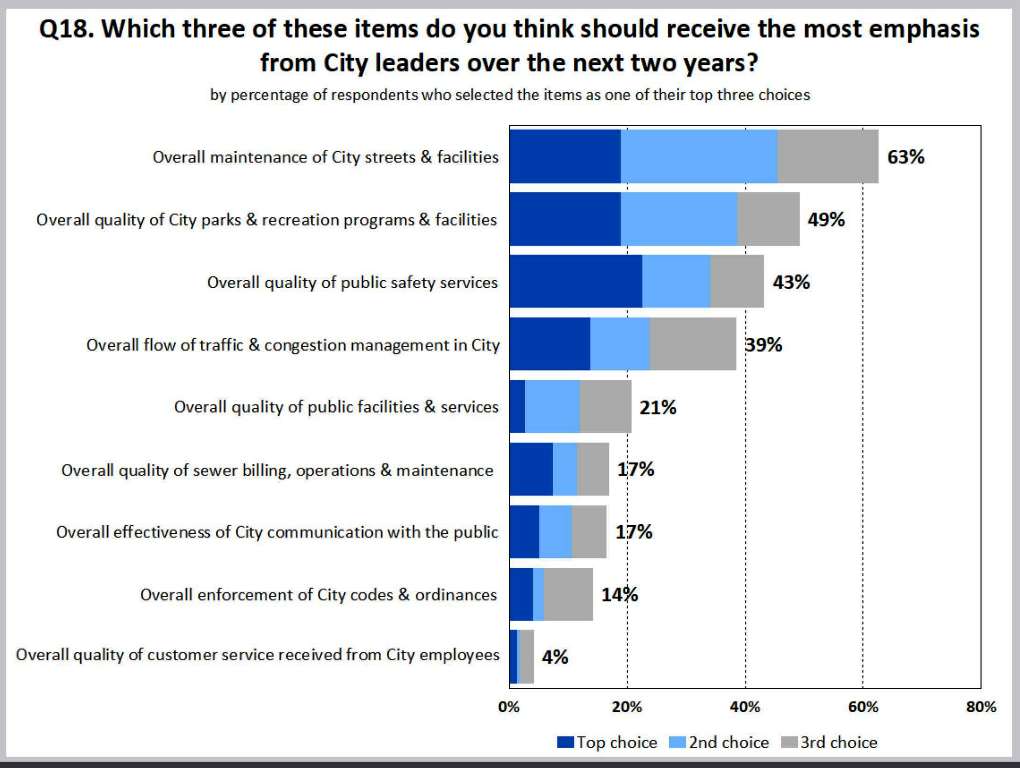

Last fall, a community survey was mailed to all Parkville households, also available online, that asked residents about their satisfaction with basic City services. The results of the survey indicated that residents were satisfied with City services. Top priorities were overall maintenance of City streets and facilities; and overall quality of City parks and recreation programs and facilities.

Frequently Asked Questions

The general levy extension is on the ballot to help fund infrastructure (streets, curbs, sidewalks) and City facilities, which was the top priority expressed by Parkville residents in the citizen survey. Many of the City’s roads are aging, deteriorated, or inadequate for current traffic volumes. Existing funding is not sufficient to address necessary repairs, upgrades, and safety improvements. If approved, the ballot measure would only be used to address City infrastructure and facilities.

If approved, 50% of the revenue would be used for:

- Repaving & repairing deteriorated streets

- Addressing roads prone to potholes & poor conditions

- Enhancing pedestrian safety (sidewalks, crossings)

- Improving drainage and stormwater systems

The remaining 50% would be used for City facilities, such as City Hall and the transportation facility.

The extension would be in effect for 20 years, after which it would need to be renewed or re-approved by voters, or terminated.

An annual report with a breakout of how the funds were spent would be made available to the public to ensure transparency.

Educational Materials

Summer Newsletter Insert

Mailer

Background on 2004 General Temporary Levy

The General Temporary Levy was established in 2004 to address the City’s capital needs, including building repairs, maintenance, and land acquisition for improvements. In April 2004, voters approved a ballot measure to increase the operating tax levy by $0.1900*, generating an estimated $2.75 million over a term not to exceed 21 years. The final year the approved levy amount was collected was 2024.

A review of records from 2003, 2004, 2006, and 2008 shows that staff developed an initial list of proposed projects in 2003 to justify the levy. However, several project cost estimates used to arrive at the $2,750,000 total were significantly lower than the actual costs. This led to the elimination of some projects to stay within budget. Others were delayed, resulting in higher costs upon completion due to inflation and changing conditions.

*Note: In Missouri, voter-approved tax levies are subject to adjustments under the 1980 Hancock Amendment, which limits government revenue growth. If property values increase faster than the Consumer Price Index, the amendment requires a rollback of the tax rate to prevent excess revenue. As a result, the original $0.1900 rate was reduced to $0.1665.