NOVEMBER 2, 2021 SPECIAL ELECTION

On November 2, 2021, Proposition A for a use tax failed.

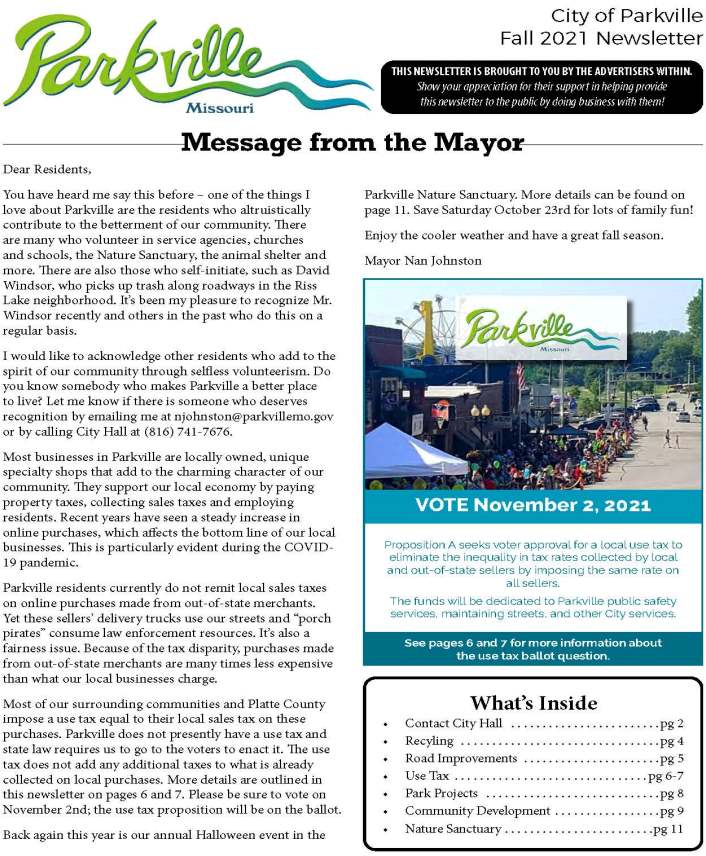

On November 2, 2021, Parkville residents were asked to vote on Proposition A, a referendum to impose a local use tax to eliminate the disparity in tax rates collected by local and out-of-state sellers by imposing the same rate on all sellers.

The City currently levies a 2 percent local sales tax. A local use tax would apply the same 2 percent rate on purchases from out-of-state sellers. Buyers do not pay both a sales tax and a use tax. They pay one or the other. Online purchases are the most common example of the use tax application.

In a changing marketplace, the City is preparing to update revenue sources to keep pace with increasing online purchases that do not support local businesses or City services. Much of Parkville’s character, including a unique downtown and other businesses, depend on local support.

Out-of-state retailers profit from Parkville buyers, but without a use tax in place, out-of-state retailers do not pay for:

- Street maintenance. Parkville streets support daily delivery trucks in the community.

- Police protection associated with traffic and package thefts.

- Other City services.

Parkville’s surrounding communities have a local use tax including: Kansas City, Riverside, Platte Woods, Platte City, Northmoor, Lake Waukomis, Gladstone, Pleasant Valley, Liberty, Smithville and others.

Ballot Language

PROPOSITION A

Shall the City of Parkville, Missouri impose a local use tax at the same rate as the total local sales tax rate, provided that if the local sales tax rate is reduced or raised by voter approval, the local use tax rate shall also be reduced or raised by the same action?

Educational Materials

Fall 2021 Newsletter

Educational Flyer #2

Frequently Asked Questions

A use tax is a sales tax on goods purchased out of state for delivery to and for use in Missouri. A use tax in Missouri can only be applied with local voter approval. The most common example of the use tax is its application to online purchases.

The City currently levies a two percent local sales tax rate but does not have a local use tax. A use tax levels the playing field by applying the same two percent rate purchased from out-of-state sellers. Parkville’s neighboring communities including Kansas City, Riverside, Platte Woods, Platte City, Northmoor, Lake Waukomis, Gladstone, Pleasant Valley, Liberty, Smithville, and others have adopted a voter-approved use tax, just a few of the approximately 227 Missouri municipalities that have a use tax.

Maintaining quality services, including Police protection and good streets, is important to the Parkville community. Traditional and dependable local revenue sources that support City services have changed. Much of Parkville’s character, such as our unique downtown and other businesses, depend on local support. The City seeks to modernize its revenue resources to keep pace with increasing online purchases that do not support local businesses.

Out-of-state retailers profit from sales within the city, but they do not pay for:

- Street maintenance for the daily delivery trucks in the community

- Police protection associated with traffic and package thefts

- Other City services.

A use tax supports our local businesses and the entire community by eliminating the advantage out-of-state retailers have over Parkville’s brick and mortar local retailers. A use tax assures out-of-state businesses pay their fair share for street maintenance, police protection, and other City services.

Local retailers pay all other City fees and taxes, such as licenses, sales tax, utility taxes, and property taxes. Online and out-of-state retailers, such as Amazon, Walmart, and Target, do not pay these taxes that support our community.

The funds collected through the use tax will be used in part for Parkville services and public safety such as our local Parkville Police Department and to maintain and improve City streets.

The State of Missouri and Platte County already have a use tax that applies to purchases Parkville residents and businesses make on out-of-state purchases. Parkville voter approval would provide a local portion to our community and remove the current tax inequality. Approximately 227 Missouri municipalities have adopted a voter-approved use tax, including most of Parkville’s neighboring communities – Kansas City, Riverside, Platte Woods, Platte City, Northmoor, Lake Waukomis, Gladstone, Pleasant Valley, Liberty, Smithville, and others.

A person does not pay both a sales tax and a use tax. They pay one or the other (maximum 2 percent) for either the local retail purchase or the out-of-state purchase.

If you already pay sales tax on an out-of-state purchase, you do not pay the use tax.

With voter approval, a local use tax will become effective January 1, 2022.

If the use tax is not approved:

- Out-of-state sellers will have an advantage over local businesses with the inequality of tax rates and no use tax going to the City.

- The City of Parkville and Parkville businesses will be negatively impacted by online sales and no use tax collected for City services.

- The City of Parkville will need to look for revenue in other places to make up lost sales tax revenue.

- City services may decline with decreased revenue sources.

The General Municipal Election is on Tuesday, November 2, 2021. The polls will be open from 6 a.m. to 7 p.m. Parkville residents vote at the Parkville Presbyterian Church, 819 Main Street.