Both Proposition T and Proposition were passed by Parkville voters on November 7, 2023.

Proposition T | Proposition M

- Fall Newsletter

- Mailer

- Proposition T

- Proposition M

Mailer

Click on the images to view the document.

Fall Newsletter Insert

Click on the images to view the document.

Click on the images to view the document.

Proposition T – Trails & Transportation

Ballot Language:

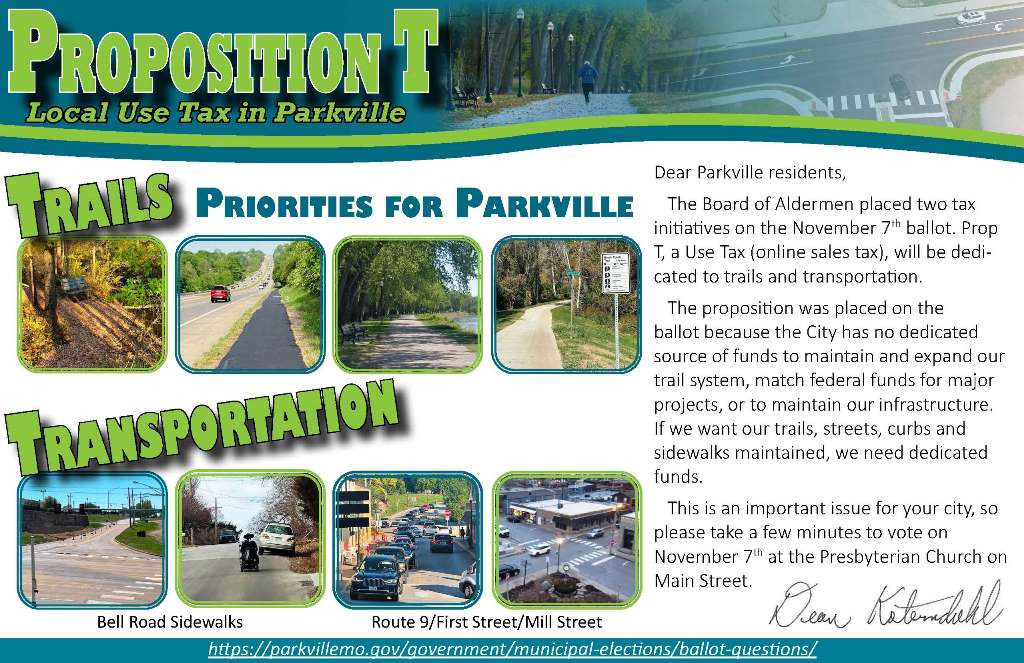

For the purpose of funding roads, infrastructure and capital projects, including, without limitation, capital grant related projects requiring City of Parkville matching funds, including 9 Highway at East Street (triangle), future phases of 9 Highway (between 6th Street and Lakeview Drive) and the Bell Road connectivity project for sidewalks; and funding for the construction, maintenance, and repair of, and improvements to, pedestrian corridors, multi-use trails, and recreation trails, shall the City of Parkville, Missouri, impose a local use tax at the same rate as the total local City sales tax rate, currently two and one-half percent (2.50%), provided that if the local sales tax rate is reduced or raised by voter approval, the local use tax rate shall also be reduced or raised by the same action?

Click on the images to view the document. Click on the images to view the document.

Click on the images to view the document.

For the purpose of funding roads, infrastructure and capital projects, including, without limitation, capital grant related projects requiring City of Parkville matching funds, including 9 Highway at East Street (triangle), future phases of 9 Highway (between 6th Street and Lakeview Drive) and the Bell Road connectivity project for sidewalks; and funding for the construction, maintenance, and repair of, and improvements to, pedestrian corridors, multi-use trails, and recreation trails, shall the City of Parkville, Missouri, impose a local use tax at the same rate as the total local City sales tax rate, currently two and one-half percent (2.50%), provided that if the local sales tax rate is reduced or raised by voter approval, the local use tax rate shall also be reduced or raised by the same action?

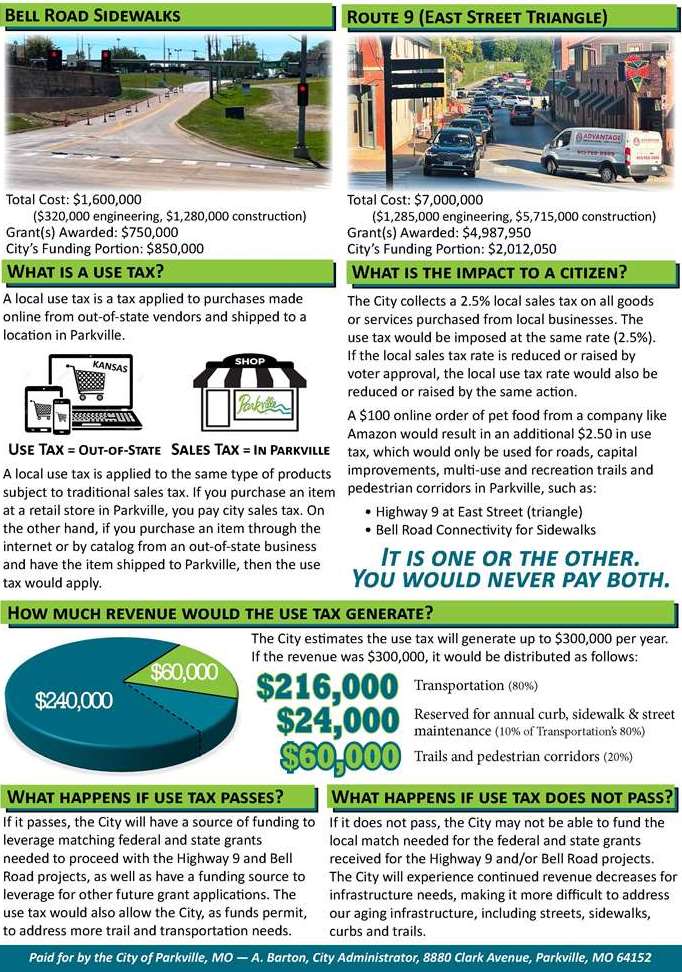

A local use tax is a tax applied to purchases made online from out-of-state vendors and shipped to a location in Parkville. A local use tax is applied to the same type of products subject to traditional sales tax. If you purchase an item at a retail store in Parkville, you pay city sales tax. On the other hand, if you purchase an item through the internet or by catalog from an out-of-state business and have the item shipped to Parkville, then the use tax would apply. It is one or the other, NEVER BOTH.

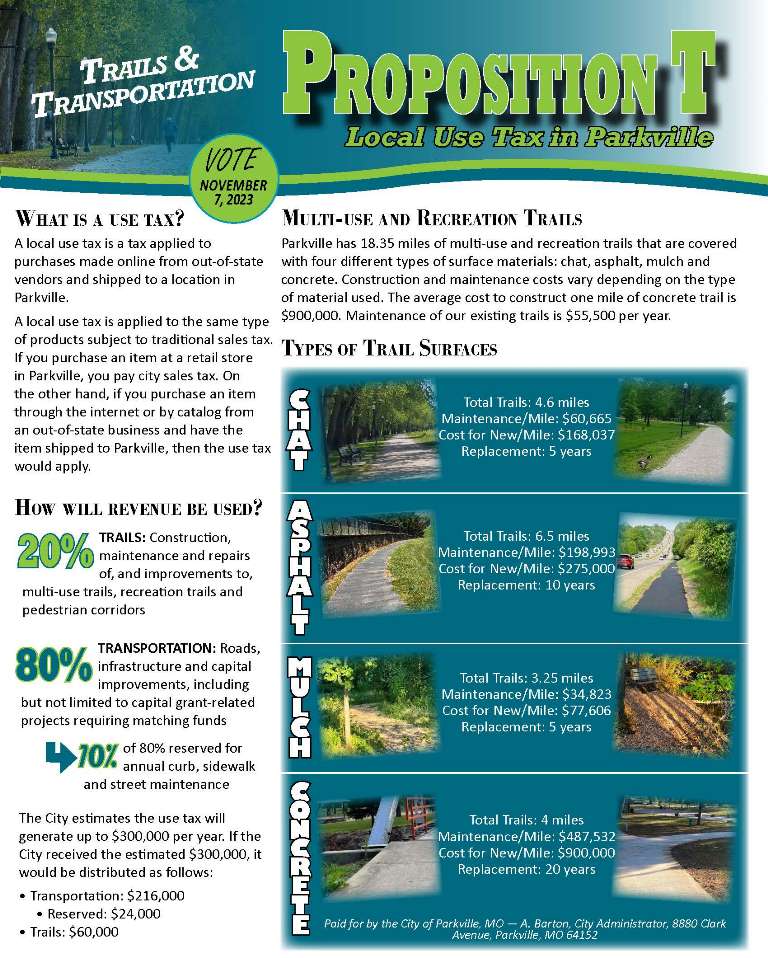

With assistance from the Missouri Municipal League, the City estimates the use tax will generate around $300,000 per year.

The City collects a 2.5% local sales tax on all goods or services purchased from local businesses. The use tax would be imposed at the same rate (2.5%). If the local sales tax rate is reduced or raised by voter approval, the local use tax rate would also be reduced or raised by the same action.

A $100 online order of pet food from a company like Amazon would result in an additional $2.50 in use tax, which would only be used for roads, capital improvements, multi-use and recreation trails and pedestrian corridors in Parkville.

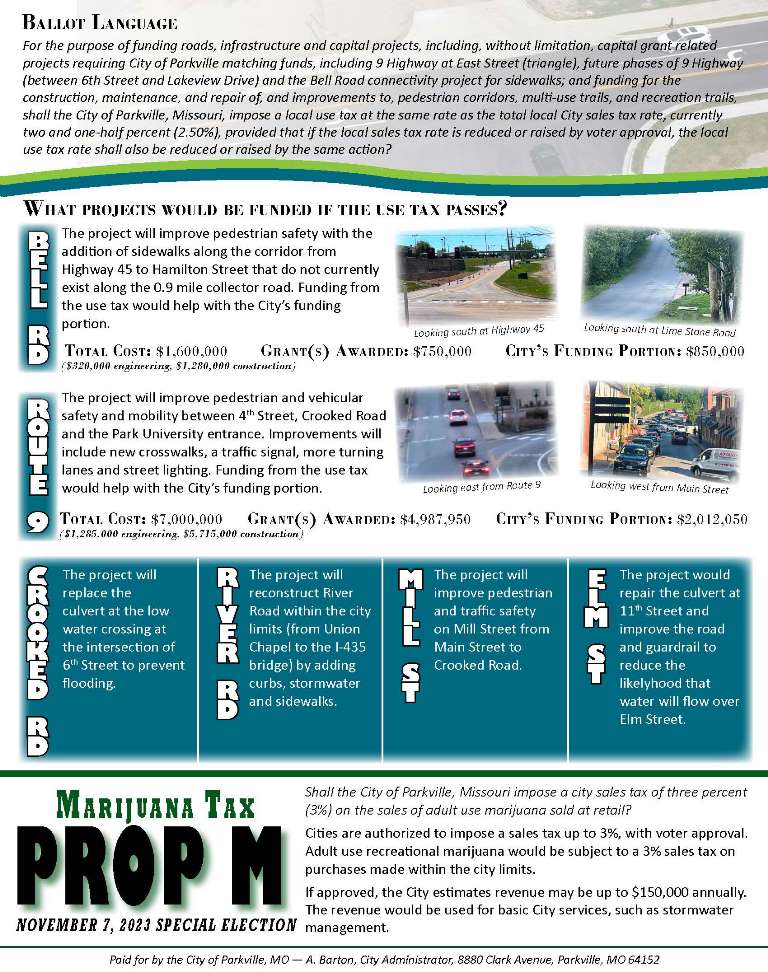

If approved, funds from the use tax will be used to fund capital grant-related projects requiring matching funds, including:

- 9 Highway at East Street (triangle)

- Future phases of 9 Highway (between 6th Street and Lakeview Drive)

- Bell Road connectivity project for sidewalks

- Construction, maintenance, and repair of, and improvements to, pedestrian corridors, multi-use trails and recreation trails,

- Other transportation projects, such as Crooked Road at 6th Street, River Road, Mill Street from Main to Crooked Road and Elm Street culvert repair.

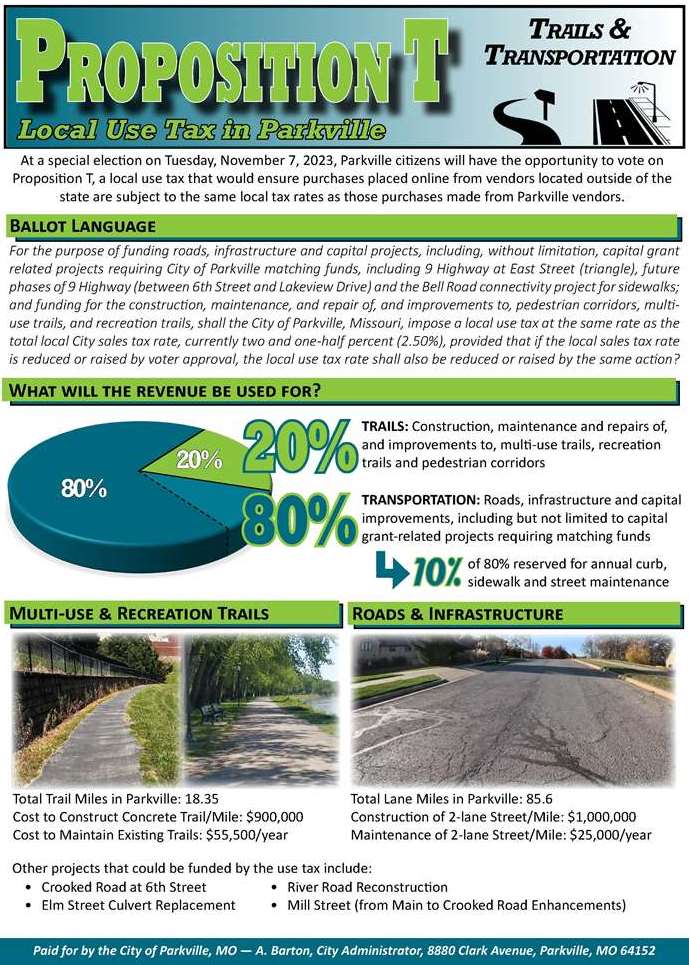

The funds would be distributed as follows:

- 20% TRAILS: Construction, maintenance and repairs of, and improvements to, multi-use trails, recreation trails and pedestrian corridors

- 80% TRANSPORTATION: Roads, infrastructure and capital improvements, including but not limited to capital grant-related projects requiring matching funds

- 10% of 80% reserved for annual curb, sidewalk and street maintenance

There is no sunset.

To maintain existing City services and provide the capital improvements our residents expect, the City needs to modernize its revenue sources to keep pace with current and evolving retail purchasing trends. According to the U.S. Department of Commerce Statistics, ecommerce sales accounted for more than 14% of all retail sales in the U.S. ($861 billion), and ecommerce sales are forecast to rise to nearly 22% by 2025. It is anticipated this trend will continue as more and more people shop online and with out-of-state vendors. A local use tax will eliminate the disparity in tax rates collected locally and from out-of-state and online vendors. Moreover, it will create a source of funding to leverage the matching Federal and state grants the City is applying for – and receiving – to improve our streets and sidewalks.

NO. A local use tax will NOT increase or change our local sales tax. If approved, the use tax will be applied to out-of-state and online purchases. The use tax is in place of a sales tax so it is only collected when sales taxes are NOT collected. A local use tax would be applied to goods purchased, delivered and used in Parkville from certain online and out-of-state vendors. The current sales tax rate received to the City is 2%. If approved, the use tax would be the same as the city sales tax. Buyers NEVER pay both a use tax and local sales tax on the same transaction.

Yes. In the metro, Independence, Lee’s Summit, Liberty, Gladstone, Grandview and Clay County (just to name a few) have passed a use tax. Also our nearby neighboring municipalities of Kansas City, Riverside, Platte City and Platte County all have a use tax in place. Statewide, nearly half of Missouri cities have a use tax in place.

Yes. Currently, Parkville’s local retailers collect sales taxes. Some out-of-state retailers collect local taxes while others do not. The use tax will subject all out-of-state and online retail sales purchased to the same tax rate.

Yes. If an item is exempt from state and local sales tax, it is also exempt from the state and local use tax. The use tax will not apply to utilities, gasoline or prescription drugs.

Just like a sales tax, the State of Missouri collects use taxes from businesses and individuals and distributes those revenues to the cities and counties that have a use tax. Businesses generally file Use Tax returns along with their sales taxes. Many retailers are now collecting use tax from customers on catalog or online purchases. For individuals, the State of Missouri currently relies on self-reporting on a use tax return if the individual has more than $2,000 in out-of-state purchases subject to use taxes on which such taxes were not paid. For simplicity, the Use Tax return is a part of your annual tax return. If you are filing a Use Tax Return now for the existing State and County use taxes, you would add the City portion.

If it passes, the City will have a source of funding to leverage matching federal and state grants needed to proceed with the Highway 9 and Bell Road projects, as well as have a funding source to leverage for other future grant applications. The use tax would also allow the City, as funds permit, to address more trail and transportation needs.

If it does not pass, the City may not be able to fund the local match needed for the federal and state grants received for the Highway 9 and/or Bell Road projects. The City will experience continued revenue decreases for infrastructure needs, making it more difficult to address our aging infrastructure, including streets, sidewalks, curbs and trails.

Without a use tax in place, a resident can purchase the same item online that they could purchase from a Parkville store, but they don’t have to pay sales tax on the online item. This creates a disadvantage to local businesses because it makes the same product seem more expensive in a Parkville store due to the local sales tax. A local use tax eliminates the disparity in tax rates collected by local and out-of-state sellers by imposing the same rate on all sellers.

Out-of-state sellers profit from Parkville buyers, but without a use tax in place, out-of-state sellers do not pay for street maintenance (Parkville streets support multiple delivery trucks daily) or police protection associated with traffic and package thefts.

Proposition M – Marijuana Tax

Ballot Language:

Shall the City of Parkville, Missouri impose a city sales tax of three percent (3%) on the sales of adult use marijuana sold at retail?

Click on the image to view the document.

Shall the City of Parkville, Missouri impose a city sales tax of three percent (3%) on the sales of adult use marijuana sold at retail?

A YES vote means the voter approves the collection of the 3% local sales tax on recreational marijuana purchases made within the Parkville city limits. A NO vote means no local sales tax for recreational marijuana will be collected.

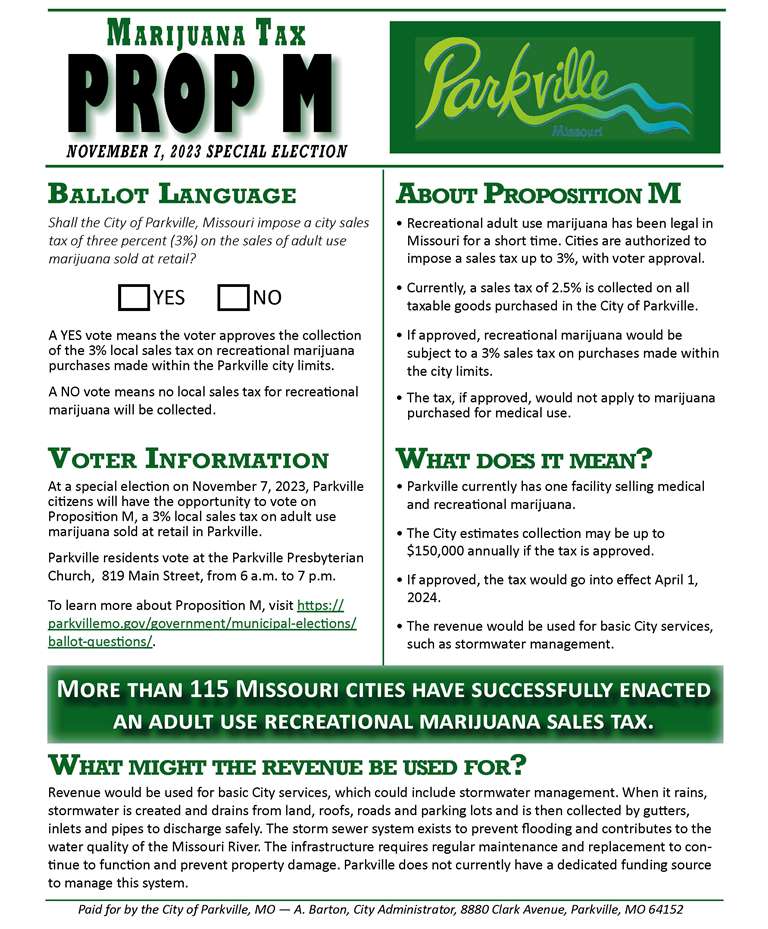

Recreational adult use marijuana has been legal in Missouri for a short time. Cities are authorized to impose a sales tax up to 3%, with voter approval.

If approved, the City will be authorized to collect a 3% sales tax on all adult use recreational marijuana sales in Parkville. This is in addition to existing state and local sales taxes. The 3% additional adult use recreational marijuana sales tax will not apply to medical marijuana sales.

Any adult who purchases recreational use marijuana from the one licensed dispensary within Parkville.

More than 115 Missouri cities have successfully enacted an adult use marijuana sales tax, including the surrounding communities of Blue Springs, Excelsior Springs, Gladstone, Grain Valley, Grandview, Independence, Kansas City, Kearney, Lee’s Summit, Raymore, Raytown, Riverside, Smithville and Sugar Creek.

Revenue would be used for basic City services, such as stormwater management. When it rains, stormwater is created and drains from land, roofs, roads and parking lots and is then collected by gutters, inlets and pipes to discharge safely. The storm sewer system exists to prevent flooding and contributes to the water quality of the Missouri River. The infrastructure requires regular maintenance and replacement to continue to function and prevent property damage. Parkville does not currently have a dedicated funding source to manage this system.

Parkville currently has one facility selling medical and recreational marijuana. The City estimates collection may be up to $150,000 annually if the tax is approved. If approved, the tax would go into effect April 1, 2024. The revenue would be used for basic City services, such as stormwater management.

If approved on November 7, 2023, the tax would go into effect April 1, 2024.